Unveiling the Mysteries of the NSE Option Chain: A Deep Dive into Option Pricing Dynamics

Unveiling the mysteries of the NSE (National Stock Exchange) option chain involves delving into the intricate world of option pricing dynamics. The option chain, a comprehensive display of available call and put options for a particular security, serves as a roadmap for investors and traders navigating the complexities of financial markets. Check what is demat?

Option pricing is a fascinating aspect of financial markets that involves a nuanced interplay of factors. The primary components influencing option prices are the underlying asset’s price, time to expiration, volatility, interest rates, and dividend yields. Understanding how these elements interact is crucial for anyone seeking to make informed decisions in the options market.

At the core of option pricing dynamics is the concept of intrinsic value and extrinsic value. Intrinsic value is the inherent worth of an option, representing the difference between the current market price of the underlying asset and the option’s strike price. If an option has intrinsic value, it is said to be “in the money.” On the other hand, extrinsic value, also known as time value, is the additional premium attributed to factors such as time to expiration, volatility, and market expectations. Extrinsic value diminishes as an option approaches its expiration date. Check what is demat?

The Black-Scholes model, a groundbreaking formula developed in the early 1970s, revolutionized the understanding of option pricing. While the Black-Scholes model provides a theoretical framework for pricing European-style options, it has its limitations, particularly in the context of American-style options and certain market conditions. Traders and investors often use more sophisticated models and tools, including the Binomial model and numerical methods, to account for these complexities and improve the accuracy of option pricing.

Volatility plays a pivotal role in option pricing dynamics. Historical volatility measures past price movements, while implied volatility reflects market expectations of future price fluctuations. Higher volatility generally leads to higher option premiums, as the potential for larger price swings increases the perceived risk for option sellers. Traders often analyze volatility trends to anticipate potential shifts in market sentiment and adjust their strategies accordingly. Check what is demat?

Time decay, or theta, is another critical aspect of option pricing. As options approach their expiration dates, the extrinsic value diminishes, leading to a phenomenon known as time decay. This can impact the profitability of option strategies, particularly for those relying on time-sensitive movements in the underlying asset. Traders must be mindful of the time decay factor and consider it when constructing their options positions.

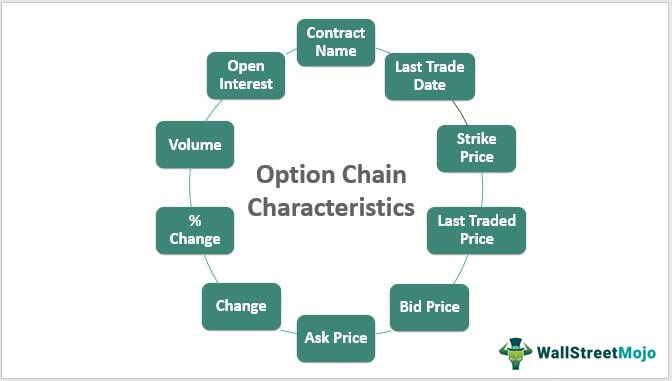

The NSE option chain serves as a real-time repository of these pricing dynamics. By examining the option chain, traders can gain insights into the prevailing sentiment, identify potential support and resistance levels, and make informed decisions about their options strategies. Additionally, the option chain provides a snapshot of open interest, indicating the number of outstanding options contracts, and volume, reflecting the total number of contracts traded during a specific period. These metrics offer valuable clues about market participation and potential turning points. Check what is demat?

Thus, unveiling the mysteries of the NSE option chain involves a deep dive into the intricacies of option pricing dynamics.